amazon flex after taxes

Self-employment taxes include Social Security and Medicare taxes. Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments.

![]()

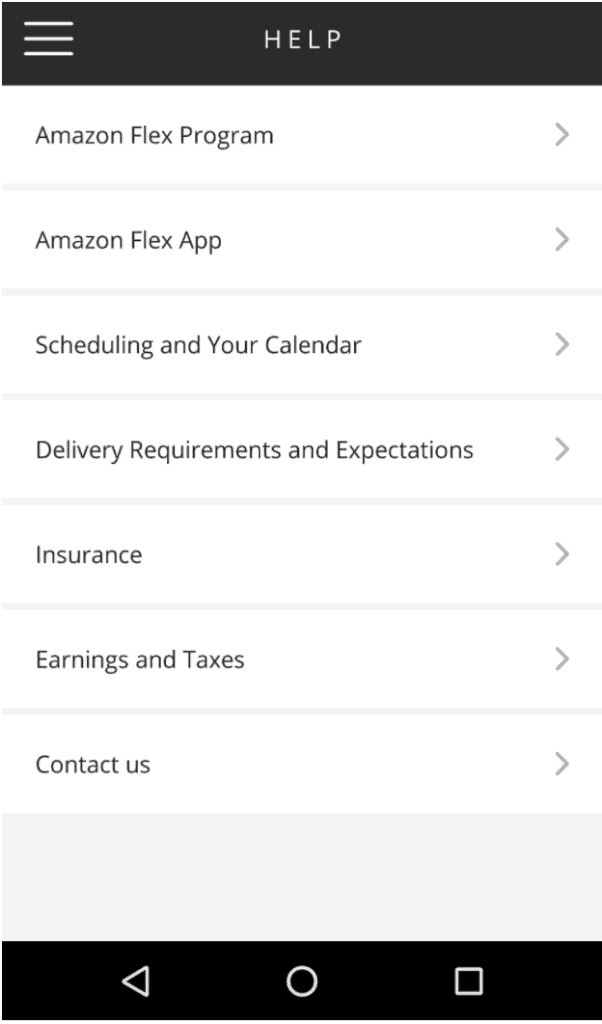

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

With Amazon Flex you work only when you want to.

. Working as an Amazon Flex driver is no different. TikTok video from Danielle Small Biz Tips itsdanielleryan. You can plan your week by reserving blocks in advance or picking them each day based on your availability.

It has 33 stars on average on Indeed. If you get a check please cash it before January 7 2022. Amazon Affiliate Independent Contractor file your taxes with a T2125.

The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019. 21 packages for 54. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year.

232 Likes 19 Comments. Amazon Flex delivery program allows drivers to find Amazon delivery opportunities in their region. We all know the phrase you need to spend money to make money.

It has 25 stars on average on Glass Door right now. Since its debut in 2015 Amazon Flex has launched in over 50 cities across the United States. With Amazon Flex you work only when you want to.

Welcome to the AmazonFlex Community where AmazonFlex Drivers come together. Look into paying estimated taxes because none is being withheld -- or the IRS will get testy with you read. If your payment is 600 or more you will receive a.

Stride is a cool and free new option for mileage tracking. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. Reply to samanthaweathers taxes for Amazon affiliates canadiantax canadatax canadiantaxes smallbusinesscanada.

I actually made 3000 after gas. Your go-to Spotify playlist or radio station might get old after a few hours. In this article well look at.

Amazon Flex is a courier service for you guessed it Amazon. Most people pay 153 in self-employment tax. Some Amazon FlexFBA workers stick to comedy podcasts to keep their mood high.

If youre looking for a place to discuss DSP topics head over to ramazondspdrivers. In fact there are numerous ways Flex drivers can save money on fuel costs. This is your business income on which you owe taxes.

When calculated it was 200 and some change per package. We know how valuable your time is. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes.

Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes. Amazon Flex drivers are independent contractors. Created Jul 5 2016.

One of the simplest ways to save money on gas as an Amazon Flex driver is to use a rewards credit card when refuelling. Youll also pay income taxes according to your tax bracket. Amazon Flex count your days.

It offers an automatic system that detects when youre driving so you can be sure to log every mile. Fine you in the spring because youll be under-withheld. This form will have you adjust your 1099 income for the number of miles driven.

56K Likes 612 Comments. Get started now to reserve blocks in advance or pick them daily based on your schedule. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply.

Amazonflex MINDORDERING amazon sidehustle atlantaamazonflex amazonflextips amazonflexdrivers. Keep your app updated to the latest version. In your example you made 10000 on your 1099 and drove 10000 miles.

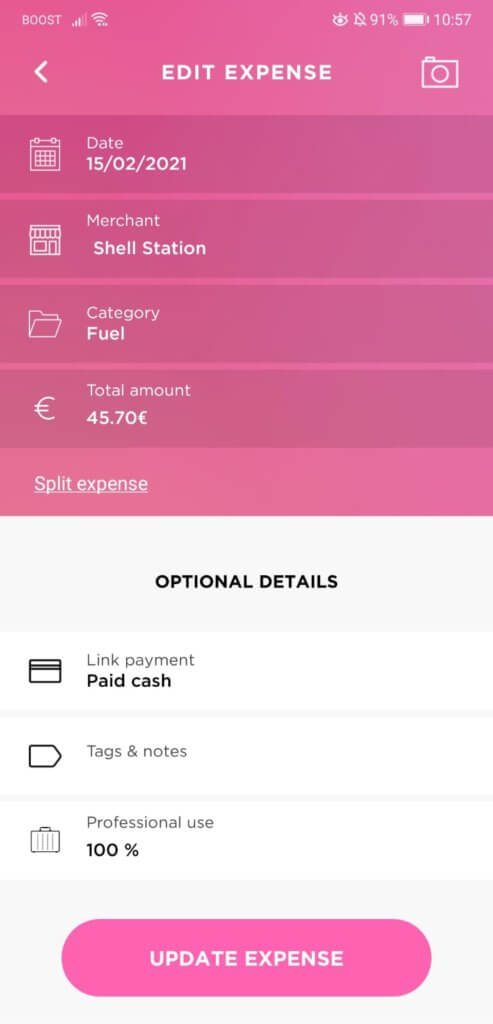

Tracking your mileage and expenses is the key to saving on taxesaka. There are plenty of gas rewards cards that pay at least 1 to 2 cash back when you refuel. That means you have to pay self-employment tax.

Having more money in. Understand that this has nothing to do with whether you take the standard deduction. Make quicker progress toward your goals by driving and earning with Amazon Flex.

Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews. 90 of the tax to be shown on. Turn to podcasts for company.

This app makes keeping track of my tax deductions a breeze. The negative reviews largely mention things like. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

Tap Forgot password and follow the instructions to receive assistance. Stack Amazon Flex with other delivery apps. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do.

Select Sign in with Amazon. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. How Much To Put Away For Quarterly Taxes.

This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Use A Gas Rewards Card. Its gone from a chore to something I look forward to.

Sign out of the Amazon Flex app. Choose the blocks that fit your schedule then get back to living your life. Watching my deductions grow.

Keep track of what you spend on Amazon Flex. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

Youre an independent contractor. Where you fall on that scale depends on a number. Whether youre saving up for that dream car or simply finding creative ways to make ends meet Amazon Flex could be a great way to earn some extra income.

Ad We know how valuable your time is. Amazon Flexs website states that you can make between 18 and 25 per hour during your blocks. Amazon Flex Reviews Online.

With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. TikTok video from Lexlo lexlo_. You expect your withholding and credits to be less than the smaller of.

Adjust your work not your life. Compared to other delivery apps Amazon Flex offers more reliable payments with most drivers earning 1825hour. Others favor terrifying true-crime podcasts like Doctor Death to keep their attention.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. Its a hardddd no. Amazon Flex drivers make their own schedule and deliver packages groceries and store orders.

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

Industrial Leasing 101 Infographic Industrial Leasing Florida Infographic Building Insurance Industrial Real Estate

How To Do Taxes For Amazon Flex Youtube

Amazon Flex Be Your Own Boss Great Earnings Flexible Hours Be Your Own Boss Work From Home Moms Extra Money

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How Much You Can Earn As An Amazon Flex Driver Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Does Amazon Flex Take Out Taxes Find Out Answerbarn

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To File Amazon Flex 1099 Taxes The Easy Way

19 Tax Write Offs For Social Media Influencers In 2021 Tax Write Offs Office Necessities Creative Apps